The UK’s competition watchdog (CMA) has opened an investigation into Amazon’s and Microsoft’s cloud services after concerns over their dominant position in the market.

The move follows a study by telecoms regulator Ofcom, which “identified features that make it more difficult for UK businesses to switch and use multiple cloud suppliers,” mainly concerning the two US tech giants.

“We welcome Ofcom’s referral of public cloud infrastructure services to us for in-depth scrutiny,” said Sarah Carell, CEO at CMA. “This is a £7.5bn market that underpins a whole host of online services — from social media to AI foundation models. Many businesses now completely rely on cloud services, making effective competition in this market essential.”

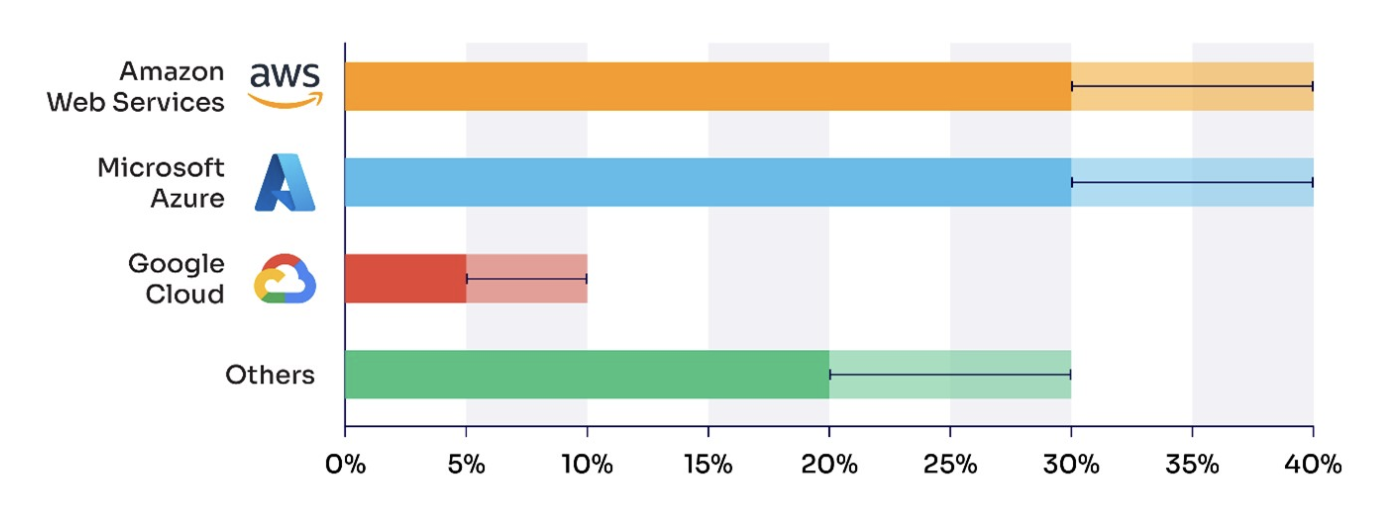

Ofcom’s study found that Amazon and Microsoft are the two leading cloud providers in the UK, with a combined market share of 70% to 80% in 2022. Google came third at 5%-10%.

The regulator is mostly worried about three features of their services:

- Egress fees: charges that customers pay to move their data out of a cloud.

- Discounts: that may incentivise customers to use only one cloud provider, even if better quality alternatives are available.

- Technical barriers to interoperability: which can prevent customers from switching between different clouds, or use more than one provider.

“Some UK businesses have told us they’re concerned about it being too difficult to switch or mix and match cloud providers, and it’s not clear that competition is working well,” said Fergal Farragher, the Ofcom director responsible for the study.

“We disagree with Ofcom’s findings and believe they are based on a fundamental misconception of how the IT sector functions, and the services and discounts on offer,” an AWS spokesperson said in a statement.

“AWS designs cloud services to give customers the freedom to choose technology that best suits their needs. UK companies, and the overall economy, benefit from robust competition among IT providers, and the cloud has made switching between providers easier than ever. Any unwarranted intervention could lead to unintended harm to IT customers and competition,” they noted.

The spokesperson also said that the company doesn’t charge separate fees to customers switching data to another IT provider, adding that Amazon “will work constructively” with the CMA.

The regulator will conclude its investigation by April 2025. It has the power to make recommendations to the government or even impose its own remedies, including requiring companies to sell off parts of their business to improve competition.

Meanwhile, Microsoft and Amazon are facing tough competition measures enforced by the EU’s Digital Markets Act (DMA). Amazon Marketplace and Amazon Ads alongside Microsoft’s LinkedIn and Windows PC OS have five months to comply with a list of rules, such as allowing consumers to uninstall pre-installed apps, or enabling business users to promote and sell their products on their own websites.

Update (11:00AM CEST, October 9, 2023): Amazon’s statement was added, following contact with TNW.

Get the TNW newsletter

Get the most important tech news in your inbox each week.