Today, Dutch neobank bunq launched its generative AI platform — Finn. Running on open large language models (LLMs) from OpenAI and Meta, the new chatbot function is designed to help users plan their finances, make better budgets, and easily find transactions. Essentially, according to bunq, enabling users to “live the life they want.”

“It is basically as if you have your own personal accountant who knows everything about your personal life, and about your transactions, and has all of this in their head and can answer whatever questions you have,” Ali Niknam, bunq’s founder and CEO tells TNW.

While the new AI chatbot interface will replace the search function on the bunq app, Niknam is eager to highlight that Finn is much more than just a search bot. Using the LLMs mentioned above (Gemini could see an integration down the road), having determined which provides the better answer, bunq has created its own model that can interpret and transform what a user is asking. This allows for answers that are “far more complex” than a typical search query.

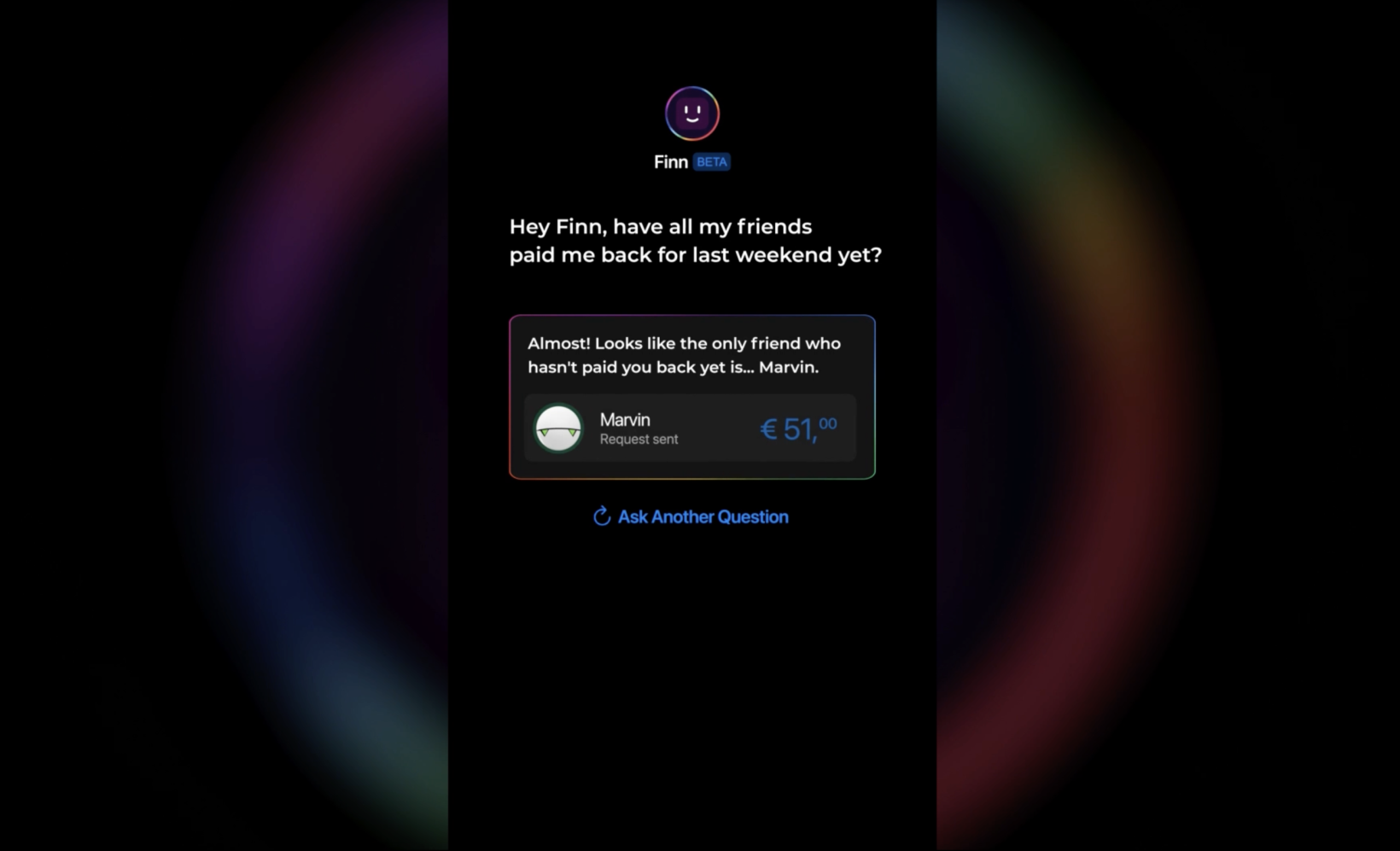

“Finn can actually give meaning to all of the data that you have generated by doing your transactions. So you can ask cool stuff like, hey, what’s my favourite restaurant nearby?” Niknam says.

Finn will feel familiar to anyone who has used an LLM user interface such as ChatGPT, or independent search engine Ecosia’s new ‘green’ chatbot. Other example prompts could be things like “how much did I spend on Amazon this year” or “what was the name of that hotel I stayed in Berlin last April.”

It can also tell users their specific spending patterns, help them budget for an upcoming trip, and tell them exactly when a purchase was made — without having to scroll forever while racking one’s brain for approximate dates (or is that just us?).

Will legacy banks launch their own AI chatbots in response?

Niknam, born in Canada to Iranian parents and raised in Gouda, the Netherlands, founded bunq in 2012. Two years later, the fintech startup became the first bank to get a European banking licence in 35 years. It reached unicorn status in 2021, and is the second largest neobank in Europe. The UK’s Revolut is the largest (bunq had to stop accepting new clients in the UK after Brexit).

When bunq launched to the public in 2015, it forced legacy banks to up their app game — which was previously pretty appalling. Could the release of Finn spark a similar rush of GenAI functions for the big banks? According to Niknam, that is a difficult question to answer.

“For competent AI people, it is not that difficult [to build an LLM chatbot], but to make something that is good, and to make something that can answer questions that are more insightful, more intelligent, than simply getting a bunch of transactions and adding them together — that is very complicated,” he states.

“Because for you to be able to do that, you need to have the storage of your data in order. And many of these legacy banks have only been able to keep up with all the app developments by building a layer on top.”

“So maybe, I wouldn’t be surprised if we get something in several months. But I would be very surprised if we get anything useful in the upcoming years,” he adds.

The benefits of being a neobank when it comes to data

It may take some time for Europe’s neobanks to earn the same household recognition as major banks that can trace their history back hundreds of years. However, when it comes to tech — and serving a tech-savvy generation — being the new kid on the block has definite advantages.

“We were working with AI a long time before we added machine learning models,” Niknam says. “So we’re way ahead of this stuff. And because we are so engineering and AI focused, we made sure from the beginning of bunq that our data structures are useful and usable by AI people. And we’re reaping the results of that.”

In all honesty, we are quite intrigued to see if Finn will make keeping track of personal finances more fun. In the meantime, we (along with a few other Amsterdammers) will be asking Finn “how much did I spend on pastry and oat flat whites in 2023” with mild trepidation.

How Finn got its name? Why, bunq asked ChatGPT “what should we call our app’s personal finance copilot,” of course.

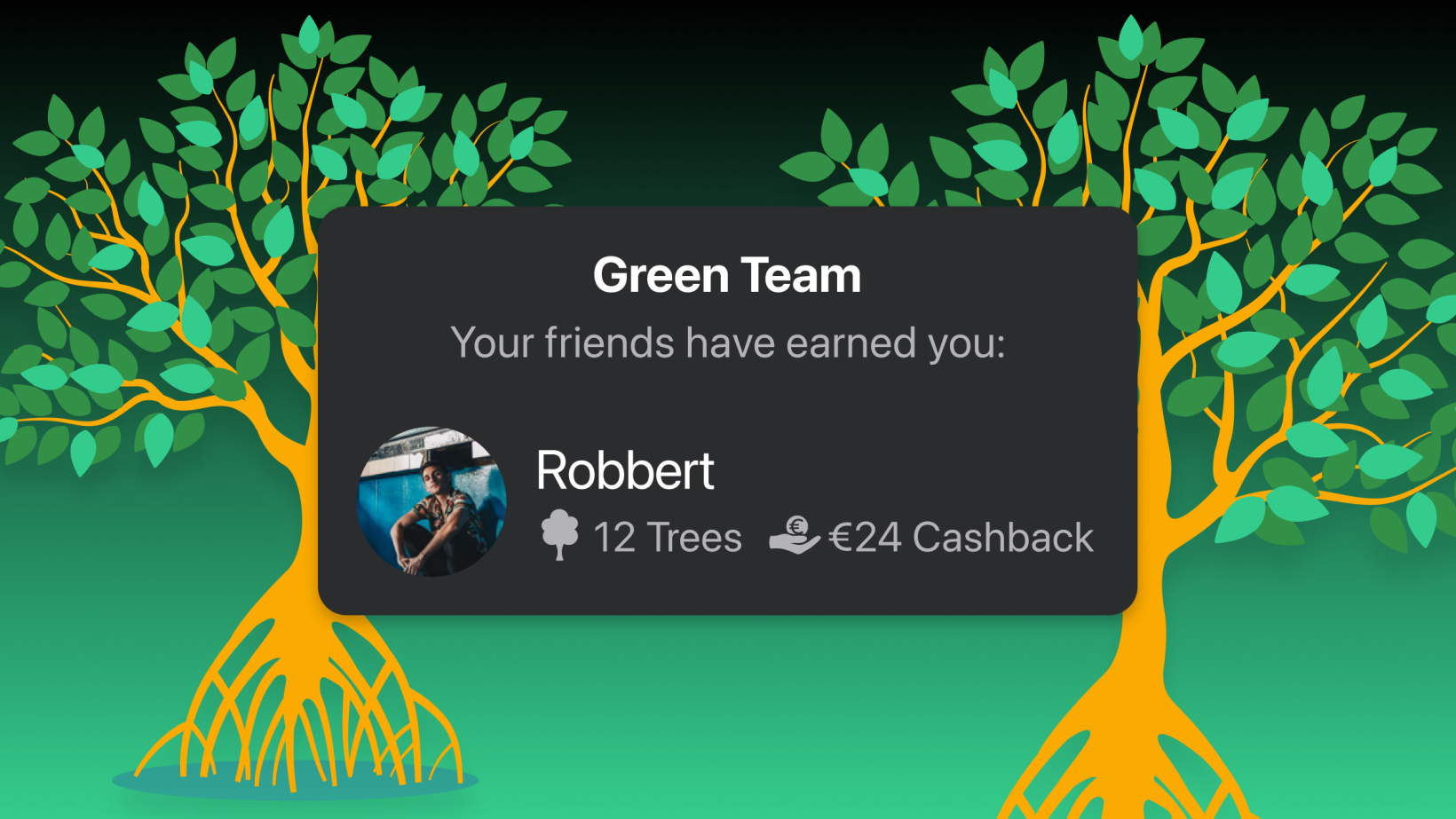

The company also launched several new features at its yearly update event. These include a new budgeting tab that lets you set spending limits and decide from which account the payment for specific items will be made, double cash back for people in the same tree-planting “green team,” free credit cards, and tap-to-pay on the phone for business users.

Get the TNW newsletter

Get the most important tech news in your inbox each week.